iPhone Demand is Close to Saturation Apple has a B Plan but Pitred the Supply Chain

[Abstract] The unfavorable thing for Apple may be a disaster for suppliers. Japan Display lowered its outlook, and more than half of the company's revenue is dependent on Apple. Subsequently, Lumentum Holdings, the world's largest maker of iPhone facial recognition sensors, also lowered its second-quarter earnings forecast.

As consumers upgrade to new phones for longer, the smartphone market is nearing saturation, and iPhone demand is waning. Apple has developed a “B Plan” that includes raising the price of each Apple phone and streaming music. Services such as digital video and data storage make more money.

But for companies that supply parts for the iPhone, they have no alternatives.

The latest evidence suggests that things that are not good for Apple may be a catastrophe for suppliers. Japan Display lowered its outlook, and more than half of the company's revenue is dependent on Apple. Subsequently, Lumentum Holdings, the world's largest maker of iPhone facial recognition sensors, also lowered its second-quarter earnings forecast.

Woo Jin Ho, an analyst at Bloomberg Intelligence, said: "Compared with Apple, its suppliers are more dependent on iPhone sales. This increases the risk of other parts of the supply chain." Apple did not respond to requests for comment.

Apple shares fell 5% on Monday, but Lumentum's share price plummeted more than 30%, and its rival II-VI company also fell 13%. South Korea's LG Innotek's revenue is about half of Apple's, the company's share price fell 9.5%. Japan Display Corporation's share price fell 11%.

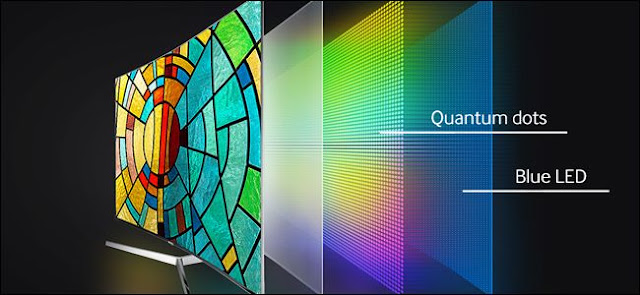

In the face of the increasingly mature smartphone market, Apple's strategy is to attract consumers to spend more money on new phones with facial recognition and better screens. 3-D sensing components from companies such as Lumentum are usually found only on iPhones that sell for more than $1,000, but few people can afford to buy that new phone.

But when these new phones go on the market, suppliers can only get one-time payments through the parts they offer, while Apple can earn hundreds of dollars more from each phone. In the most recent quarter, Apple reported that iPhone sales barely increased, but revenue from its services business grew 29% year-on-year.

If consumers are less demanding new and more expensive iPhones, Apple can cut parts orders or postpone shipments, giving suppliers more inventory. When Apple returned to the negotiating table, it made them more likely to be forced to accept price cuts.

Lumentum CEO Alan Lowe said on Monday that Lumentum's lower performance is expected to be the result of a decline in shipments from its largest customer a few days ago. Lumentum did not disclose the identity of the client, and the company's spokesperson declined to comment. But the data collected by Bloomberg shows that Apple is the company's largest customer.

Apple is increasingly promoting the number of its 1.3 billion activated devices, rather than how many iPhones are sold each quarter. Apple is always making changes to ensure that existing users are satisfied while selling more services to them.

Gene Munster, a senior Apple analyst at venture capital firm Loup Ventures, said: "Apple is no longer dependent on traditional hardware business, and its investment model is shifting from focusing on device sales to a more predictable service-driven business."

This year, Apple has taken steps to extend the use of the iPhone. This may prevent people from upgrading to buy the latest equipment, which is another ominous sign for suppliers.

Earlier this year, Apple confirmed that in order to avoid battery-related problems, the company had intended to reduce the speed of some older phones. In an objection, Apple offers a cheap battery upgrade that extends the life of many phones.

Recently, Apple introduced a new version of the operating system iOS 12, supporting the company's 28 devices, including models launched in 2013, this is an unprecedented move. The devices supported by the previous iOS upgrade will only be traced back a few years ago, but this is the first time Apple has prioritized the upgrade of the old iPhone.

Compared with the iOS 11 updated last year, the updated operating system iOS 12 is 70% faster on the old iPhone and 50% faster.

Toni Sacconaghi, an analyst at Sanford C. Bernstein & Co., wrote in a report to investors on Monday: "The use of longer-lasting products may bring Higher customer satisfaction is likely to make Apple's products more expensive and help achieve the company's environmental goals."

The analyst estimates that this may extend the iPhone replacement cycle by six months to 3.2 years and reduce annual sales by 6% in three years.

As the iPhone lasts longer, users may be more willing to subscribe to the new service, which will prompt iPhone users to bring higher income to Apple. But these services are not an additional source of revenue for component suppliers.

Although suppliers have fewer choices, they are responding to a slowdown in the smartphone market. Like most device manufacturers, Apple likes to have at least two suppliers for each component.

In response to this situation, optical component manufacturers II-VI and Finisar announced a $3.2 billion merger plan last week to create a larger company to gain more chips in negotiations with Apple.

So what is your main concern about iPhone replacement parts?

Warranty, color and brightness Stability, Return Policy, etc.

We offer Premium Quality iPhone Tianma LCD with 16 steps test along with database solutions for K value and CD value to assure color and brightness stability even in different batches.

To find the reliable supplier is very important in all business."

We are ONE-STOP Premium Quality iPhone Tianma LCD and phone parts supplier in Shenzhen since 2011.

For more details welcome to contact us by Whatsapp/Wechat:+86-18813643652; Skype:live:ymjtina; Email:Tina@cinoparts.com; Website:www.cinoparts.com

评论

发表评论