Benefit from iPhone,this Company Stock Price Soared 430% a Year

The huge shipments and profit margins of the Apple iPhone have attracted manufacturers in the upstream of the industry chain to appeal to this customer. While to be his supplier, in addition to the need for strong new technology, you must take the right vents to take off. It is no exaggeration to say that since the release of the iPhone in 2007, Apple has achieved a number of upstream suppliers. Today, the iPhone 8 is released, and another manufacturer will usher in a new outbreak.That is IQE in UK.

In fact, the vendor has risen 430% in the past year (as of September 8) before the new iPhone was released.

IQE stock price trend in the past year

A segmentation giant developed through acquisitions and mergers

According to Wikipedia, IQE was originally founded in 1988 by Dr. Drew Nelson and Dr. Michael Scott. When the company was founded, it was named Epitaxial Products International (EPI). Initially, the company produced epitaxial wafers for photonic devices primarily used in fiber-optic communications. In addition, they also use MOCVD to produce semiconductor lasers, LEDs, and photodetector devices for long-distance fiber optic communication, operating between 1300 nm and 1550 nm.

In 1999, EPI and Pennsylvania-based Quantum Epitaxial Designs (QED), founded by Tom Hirel, merged and the new company was renamed IQE. That is, the company went public in this year.

Because of this merger, the new company has new technologies such as molecular beam epitaxy (MBE) and wireless communications. Also because of this merger, IQE became the first outsourcing company in the world to offer optoelectronic and RF epitaxial wafer services based on MOCVD and MBE technologies. They also focus on producing pHEMTs and MESFETs for wireless communications applications.

In 2000, the company became a subsidiary of IQE Silicon, which specializes in the production of silicon-based epitaxial wafers. The new company uses CVD tools to provide silicon germanium epitaxial wafers for MEMS He Nano technology applications. Also during the year, IQE acquired Wafer Technology in the UK. Through this acquisition, IQE has acquired the production capacity of GaAs and InP substrates, and also acquired the ability to add GaSb and InSb for infrared applications.

By 2006, IQE was from Emcore's Electronic Materials division, which gave them a product line including HBTs and BiFETs. Also in this year, IQE acquired a company in Singapore and added MBET technology to them.

In 2009, the company acquired NanoGaN and acquired new GaN technology; in 2012, IQE acquired Galaxy Compound Semiconductors; in 2012, IQE acquired RFMD's MBE epitaxial manufacturing division.

After a series of acquisitions and mergers, IQE has grown into a company with multiple fabs with multiple technologies and product lines, and the company has grown to become the world's largest manufacturer of epitaxial wafer contracts.

According to the company's official website, IQE has been researching the hybrid semiconductor industry for more than 25 years and is recognized as the world's leading supplier of advanced silicon silicon wafer products. The core of the company's focus is on the extended business. The company's overall business is subdivided into wireless, optoelectronic, infrared, CPV, power switches, LED and advanced electronics.

IQE's revenue over the past five years

According to IQE's financial report, in 2016, their company's revenue was $132 million, an increase of 16% from 2015's $114 million. According to the business division, the wireless product division is the company's largest revenue division, followed by photonics, infrared and CMOS++. This is mainly due to their investment in advanced materials technology over the past few years, and continuous innovation has also created their main business different from other manufacturers. World-class materials technologies, including cREO, for example, provide manufacturing capabilities for silicon-based hybrid semiconductor products and silicon-based GaN products. They also launched the world's first 6-inch VESEL technology, which is believed to be the main kinetic energy of their next wave of growth.

IQE's 2016 revenue (by business unit)

Being favored by apples, it has soared 430% a year

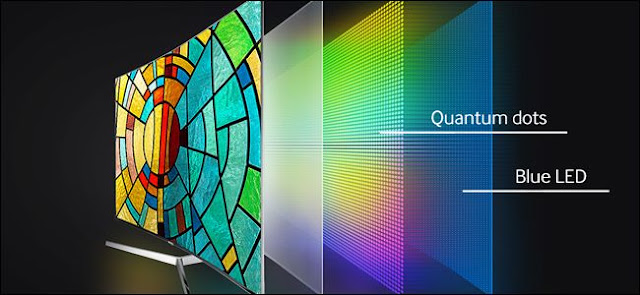

As we mentioned at the beginning of the article, if you want to get Apple's favor, you must have good quality products that meet Apple's new needs, such as the fingerprint identification chip used, such as the Samsung OLED to be applied, for example, this will be put on Apple's VESEL.

This year, around the lack of innovation in mobile devices, the topic of lack of innovation in the iPhone has been going on for a long time. Various speculations and rumors are endless, but one thing is certain that Apple will use 3D structured light technology on new mobile phones. Bringing great benefits to IQE with VESEL advantages. Because of this, in the past year, this company, which has been steadily rising over the past decade, has suddenly experienced explosive growth.

Since Apple brought fingerprint recognition on the iPhone 5S, mobile phone suppliers around the world have launched a hand-to-hand battle around this function. After the Chinese chip factory entered the game, this once blue sea seems to have become the "purgatory" of the Red Sea. Maori is killing his head here. But as a pioneer, Apple has moved to a new direction in order to maintain the innovation of mobile phones - 3D camera. The history of Apple's 3D camera development can be traced back to the acquisition of 3D somatosensory technology provider PrimeSense in 2013.

Unlike ordinary cameras, 3D cameras are equipped with location information. This allows the mobile phone to obtain stereoscopic images, which can be applied to many aspects such as face recognition, gesture recognition, background blurring and even game interaction. In order to implement such a 3D camera, there are several different solutions.

Comparison of advantages and disadvantages of centralized solutions for 3D cameras

Among them, structured light is the most mature depth detection solution in the industry. Many laser radar and 3D scanning technologies use this solution. According to the industry, Apple's new iPhone also uses this technology. In principle, this technique uses the refraction of the laser and the algorithm to calculate the position and depth information of the object, thereby restoring the entire three-dimensional space. Since the position is calculated by the displacement of the refracted light, this technique cannot calculate accurate depth information, and there are strict requirements for the distance to be recognized. Moreover, it is easily interfered by ambient light, is not suitable under strong light, and the response is slow.

Basic schematic diagram of structured light

To achieve this function, according to K.K., a well-known analyst of KGI, the structured light emitter module will include active calibration equipment, filters, wafer-level optical components, diffractive optical components, vertical cavity surface emitting lasers and epitaxy. About six components, including the components, come from 10 different manufacturers; the structured light receiver contains four components from six manufacturers, including infrared lenses, filters, and contact image sensors. And CMOS image sensor (1.4 million pixels). The focus point source VCSEL here is the focus, here is an important product line of IQE, as one of the few manufacturers of Epi-Wafer in the world, which is what Apple values. This is also the reason for their skyrocketing in the past year.

Why not non-IQE?

From the principle of structured light, the light source can be LED or laser. According to the data of Founder Securities, VCSEL (Vertical Cavity Surface Emitting Laser) has small volume, high photoelectric conversion efficiency and high precision. Low cost, narrow wave

Features such as flaps make it the most suitable source for consumer electronics. The wavelength is generally chosen to be 940 nm.

Looking back at the history of VCSEL, since the end of the 1980s, the research team led by KENICHI I of Tokyo Institute of Technology in Japan has been commercialized. In 1996, Honeywell launched the VCSEL transmission module, followed by Emcore, Picolight and other companies. VCSELs products have also been offered. The raw materials for light emission and light detection of these products are mainly gallium arsenide (GaAs) and indium gallium arsenide (InGaAs), and epitaxial wafers are formed by organic metal vapor deposition (MOCVD). Compared with the general side-projection type laser, the mirror surface required for the resonant cavity and the photon to resonate back and forth in the resonant cavity is not formed by the natural lattice fracture surface formed by the process, but is formed when the element structure is epitaxially grown.

The general surface-emitting laser structure generally comprises a luminescent active layer, a resonant cavity and a Bragg reflector (Highly Reflected Bragg Reflector); when the photon is generated in the luminescent active layer, it is easy to oscillate back and forth in the resonant cavity. In the case of population inversion, the laser is formed directly above the component. The VCSEL adopts a surface-emitting type, and the laser light has a conical shape, which is easier to couple with the optical fiber, and does not require an additional optical lens.

Due to the extremely short thickness of the surface-emitting laser cavity, it has the characteristics of vertical single mode, circular light shape, low current and low power loss, stable high temperature characteristics, and two-dimensional array. The medium and short distance data transmission system requires active light components and important components of the laser mouse.

VCSEL structure diagram

In this product, the manufacturing process has always been a huge challenge for this technology.

EELs have lower yields due to complex processes and the reliability issues associated with COD (the EELs chip manufacturers for 980nm pumps typically only get about 500 dies from 6.66 cm (2 inch) wafers). The production of VCSELs exceeds 90% (equivalent to approximately 5,000 high-power dies from 2-inch wafers). In fact, because of its two-dimensional nature, VCSELs are manufactured in exactly the same way as standard silicon integrated circuits. A key advantage of high-power VCSELs is that they can be processed directly into a single-dimensional two-dimensional array, which is impossible for EELs (only one-dimensional arrays are possible).

From the perspective of the industry chain, IQE is the key to the upstream, which is an important reason for analysts and Apple to be optimistic about him.

Thanks to years of research and development, IQE has become the leading supplier of VCSEL products on the market, and their products record the speed of 64Gb/S. In addition, according to IQE, this product will be applied to gesture judgments, safety judgments or other markets for self-driving cars.

So what is your main concern about iPhone replacement parts?

Warranty, color and brightness Stability, Return Policy, etc.

We offer Premium Quality iPhone Tianma LCD with 16 steps test along with database solutions for K value and CD value to assure color and brightness stability even in different batches.

To find the reliable supplier is very important in all business."

We are ONE-STOP Premium Quality iPhone Tianma LCD and phone parts supplier in Shenzhen since 2011.

For more details welcome to contact us by Whatsapp/Wechat:+86-18813643652; Skype:live:ymjtina; Email:Tina@cinoparts.com; Website:www.cinoparts.com

评论

发表评论